By Ramsha Irfan on Oct 18, 2023

~ 4 minutes to read

Nowadays, many people fail to understand what SYNCB PPC is when they are checking their credit report. Since it appears on their credit report, people are unable to comprehend what SYNCB PPC stands for and why it is appearing on their credit report. To put on end to your and everyone’s query, we have to come up with this article. We will discuss what SYNCB PPC is, why it appears on your credit report and how to remove it from your credit report in this article.

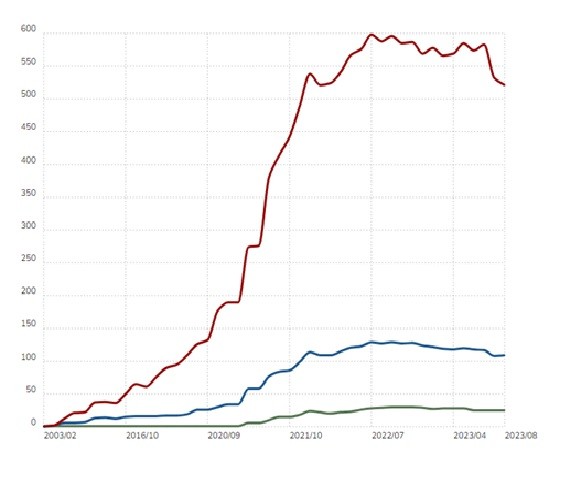

The full form of SYNCB PPC is Synchrony Bank PayPal Credit. PayPal sold its accounts receivables/debts to Synchrony Bank in 2018, which includes Bill Me Later accounts previously owned/offered by PayPal. PayPal has more than 500 million credit users in 2023. This simply means that if you are PayPal credit card holder, you owe your payables to Synchrony Bank.If you have borrowed loans/credit from PayPal, then SYNCB PPC will appear on your credit report. On the contrary, if you have not borrowed any loan/credit from PayPal and still SYNCB PPC appears on your credit report, or if there is any inaccuracy or discrepancy in your credit report, we will guide you in detail on how to get rid of it.

Before moving on, we will give you an overview of Synchrony Bank, in case if you are not aware of it.

Synchrony Bank was launched in 1932, and today it offers more than 100 credit card options to people, which includes renowned companies such as Banana, Chevron, PayPal, Sams Club and eBay. Moreover, Synchrony Bank has not only bought credit receivables of PayPal, but of 116 companies which include Walmart, Amazon, JC Penny and many more. In addition to this, PayPal and Synchrony Bank have been in partnership since 2004. The specialty of synchrony Bank is that it offers smooth credit to its customers. There are more than 75.5 million active users of Synchrony Bank account.

If you have applied for PayPal credit, then SYNCB PPC will appear on your credit report. Before Synchrony Bank purchased PayPal’s accounts receivables, PayPal kept its creditors information confidential, therefore, it did not reported its borrower’s information to any credit bureau or agency. This is the reason why SYNCB PPC did not appeared on PayPal borrower’s credit report, before 2018. Furthermore, if you have borrowed loan/credit from PayPal before its collaboration with Synchrony Bank, it will appear on your credit report because Synchrony Bank send its borrower’s information to credit bureau and credit agencies, which include TransUnion, Equifax and Experian.

Once you have applied for PayPal credit, it will generate a hard inquiry, which is also known as a hard pull. Hard inquiry involves investigation of borrower or loan applicant’s credit history, which involves borrower’s repayment history and amount borrowed. Synchrony Bank carries out hard inquiry of its receivables to secure their risk. Since every credit involves some risk, Synchrony Bank and other financial institutions want to minimize it.

If the loan applicant’s credit score is not good, his/her credit application will be rejected. It’s a rule of thumb for every bank that if a loan applicant has a history of applying for new loans and credits frequently, then they are not worth lending. Hence, their application gets rejected.

Hard inquiry is carried out in case of new application for credit or an increase in existing credit you have borrowed. If you have applied for PayPal credit for the first time, it may lower your credit score, but you can improve it by making timely repayments. However, it will get worst if you fail to repay the amount timely or your credit utilization rate is high. Adding on, hard inquiry will appear on your credit report for two years and there is no way to avoid it.

Although it seems logical that SYNCB PPC appears on your active account, you must be curious why it appears on your closed accounts. If you have closed your credit account willingly, or if the financial institution has closed it due to failure to repay, or inactivity, Synchrony Bank will send your details to credit agencies (mentioned earlier) and bureau once you apply for PayPal credit. Closed accounts remain a part of your credit history for years. Thus, it adversely affects your credit score.

If you have applied for PayPal credit, there is no way you can get rid of SYNCB PPC appearing on your credit report. On the contrary, if you have not applied for PayPal credit or you do not have a PayPal credit account, then it might be due to the following reasons:

There are chances of reporting incorrect details of the loan applicant by Synchrony Bank Therefore, details of the wrong person are sent to credit agencies and bureau, which further results in appearance of SYNCB PPC on another person’s credit report.

There are fraudulent people everywhere. Hence, there are chances that someone has used your personal information to apply for PayPal credit, which can further lead to SYNCB PPC appearing on your credit report. Even if you do not have a PayPal account or have never applied for PayPal credit, SYNCB PPC can continue to appear on your credit report.

Considering the above-mentioned reasons, you can take various measures to remove SYNCB PPC from your credit report. Its best to check your credit reports through annualcreditreport.com. Moreover, you can notify the credit bureau and credit agencies through email, phone call or post. Moving on, if SYNCB PPC appears on your credit report you can feel free to contact PayPal’s fraud reporting department. Since Synchrony Bank has also collaborated with other companies, in terms of offering credit, the acronym SYNCB can appear on your credit report, showing your payables against other company or brand. Therefore, you can freely contact Synchrony Bank or speak to their representative at mysynchrony.com.

We have come to the conclusion that if SYNCB PPC appears on your credit report, there are mainly four possibilities of it. The most common and genuine possibility is that you have applied ofr PayPal credit. Other possibilities include that you either have an active or deactivated PayPal credit account, or there is some error at PayPal or Synchrony Bank’s end or someone has stolen your personal information to misuse it. Therefore, take safety measures such as avoid passing on your personal details to any unknown person or unverified platform, and check your credit report regularly at the given website.

Ramsha is a talented writer known for top-quality content on trending topics. Her excellence in research enables her to add value to businesses by driving online traffic with engaging and persuasive content.